Professional Consultants Certificates (Architects Certificates)

What were once generally known as Architects Certificates for newly built or converted property are now known as 'The Council of Mortgage Lenders (CML) Professional Consultants Certificates'. When developers are building or converting residential properties, they generally need to provide some form of assurance to potential purchasers and their lenders that their position is protected in the event that structural problems develop with the property sometime after handover. Many lenders will generally only lend on newly built (or newly converted) properties where the developer can offer a building guarantee scheme (i.e. those offered by NHBC or other insurance companies) or a qualified professional acting as the professional consultant (e.g. a member of CIAT, RICS or RIBA) has signed a Council of Mortgage Lenders (CML) Professional Consultant’s Certificate (Architects certificate). Basically, developers need this type of certificate if they’re selling the property and their purchaser needs a mortgage or if they want to rent the property and raise a Buy-to-Let mortgage to release equity.

Lenders indicate if they will accept the Professional Consultants Certificates in their Part 2 responses to 6.7.4 of the Lenders' Handbook. The Lenders' Handbook provides comprehensive instructions for conveyances acting on behalf of lenders in residential conveyance transactions. This form of the certificate has been pre-approved by the CML and they will only accept the Professional Consultants Certificates for financial transactions which can only be signed off by a properly insured Professional Consultant.

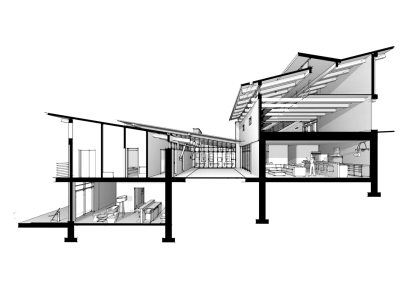

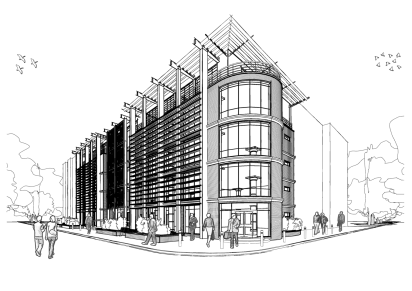

We provide Professional Consultants Certificates (Architects cert.) for new-build and/or conversion of residential dwellings. We are qualified and Professional Indemnity insured (up to £1M) to design and/or monitor the construction or conversion of residential buildings and certify the completion to enable lenders to release funds. By signing the certificate we confirm to the lender (or its conveyancer) that we:

- have visited the property to check its progress of construction, its conformity with drawings approved under building regulations and its conformity with drawings/instructions issued under the building contract;

- will remain liable to the first purchasers and their lender and subsequent purchasers and lenders for the period of 6 years from the date of the certificate;

- have appropriate experience in the design and/or monitoring of the construction and conversion of normal residential buildings; and

- will keep a certain level of professional indemnity insurance in force to cover our liabilities under the certificate.

Adobe Acrobat document [38.2 KB]